Our Services

An introduction

Many businesses encounter problems when seeking for long-term financing, especially when looking for fixed interest rates. Other issues could be that they cannot match the equity amount required of a lender for conventional loan terms or collateral may not meet the loan-to-value requirement of the lender. Recognizing this, the U.S. Small Business Administration (SBA) offers the 504 Loan Program which gives businesses a financing alternative. We, at Capital Access Corporation-Kentucky, administer the 504 Loan Program.

Another great advantage is that we do not compete with a bank - but partner with one - in order to be able to provide you long term, fixed rate loans.

Are you ready for a financial alternative?

How the Program Works

CAPITAL ACCESS

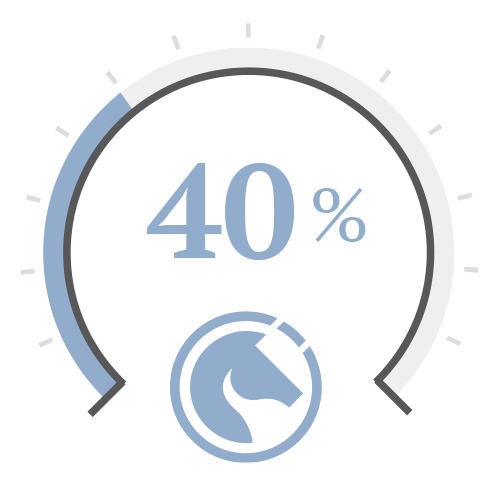

We lend up to 40 percent of the total fixed asset financing need, to a maximum of $5,000,000*.

BANK / LENDER

A private lender, usually a bank, lends up to 50 percent of the project's total cost.

YOUR BUSINESS

The business provides a minimum of 10 percent of the necessary funds.

(Higher equity requirements exist for start-up or leveraged companies in specialized industries.)

*This amount can be increased to $5,500,000 for manufacturing concerns or "green" projects (projects that create at least 10% reduction in energy consumption. See tab on Green Projects for more information).

The interest rate on our loans are fixed and generally a little above the rate of long-term Treasury Bonds. The loan maturity is 10, 20, or 25 years. The interest rate on the companion bank loan is negotiated by the borrower and typically is floating.

General Loan Structure

Through the 504 loan program, we can provide up to 40% of the eligible project costs. The borrower provides an equity injection of at least 10% and a private lender provides up to 50% of the project costs.

| Typical Loan Structure | |

| Land | $100,000 |

| Building | 800,000 |

| Equipment | 50,000 |

| Professional fees | 50,000 |

| Total | $1,000,000 |

| SBA 504 - Loan Structure | |

| Bank Loan | $500,000 (50%) |

| SBA | 400,000 (40%) |

| Equity | 100,000 (10%) |

| Total | $1,000,000 |

Eligibility

Generally, any project involving the purchase, construction, or improvement of fixed assets is eligible.

Examples include:

- Land and building acquisition

- Construction and renovation

- Purchase of heavy machinery or equipment

-

Refinancing of loans that were originally used for the items above.

Reasonable construction contingencies (up to 10 percent), furniture and fixtures, and soft costs (such as professional fees and interest during construction) generally can be included. Investment and residential properties are not eligible.

In applying for a 504 loan, businesses must meet each of the following requirements:

- Property must be either owner-occupied or owned by an eligible passive company. Various lease options exist between the proposed borrower/landowner and the tenant/operating entity. Generally, so long as both entities are otherwise eligible under SBA rules and both either are obligated or guarantee the debt, the project is eligible. If questions concerning this issue should arise, they should be directed to the staff of Capital Access Corporation-Kentucky.

- Project must, according to SBA guidelines, promote economic development. Generally, this entails the creation or retention of jobs. For every $65,000 $75,000 that Capital Access Corporation-Kentucky lends, or $100,000 $120,000 for manufacturing concerns, reasonable projections should indicate that one full-time or full time equilavent (e.g. 2 part-time jobs @ 20 hours/week = 1 FTE) will be created or retained over the next two years. Some business sites and types and locations are exempt from job creation criteria and exceptions are possible.

- The business must be for-profit and together with all affiliates must average over the past two years less than $5 million in annual profits and $15 million in net worth. (Alternative, higher size standards are available in certain industries, i.e., manufacturing).

- Total eligible project cost must be at least $100,000 $75,000. This includes a minimum Capital Access Corporation-Kentucky loan of $25,000.

Professional Fees

Expenditures for professional services and fees directly attributable and essential to the project are eligible. Examples are:

- Appraisal report fee

- Construction loan interest

Have more questions before applying, contact us.

We appreciate you and are available to answer any questions you may have. Please fill in the below form and a representative will be in touch with you within 48 hours.